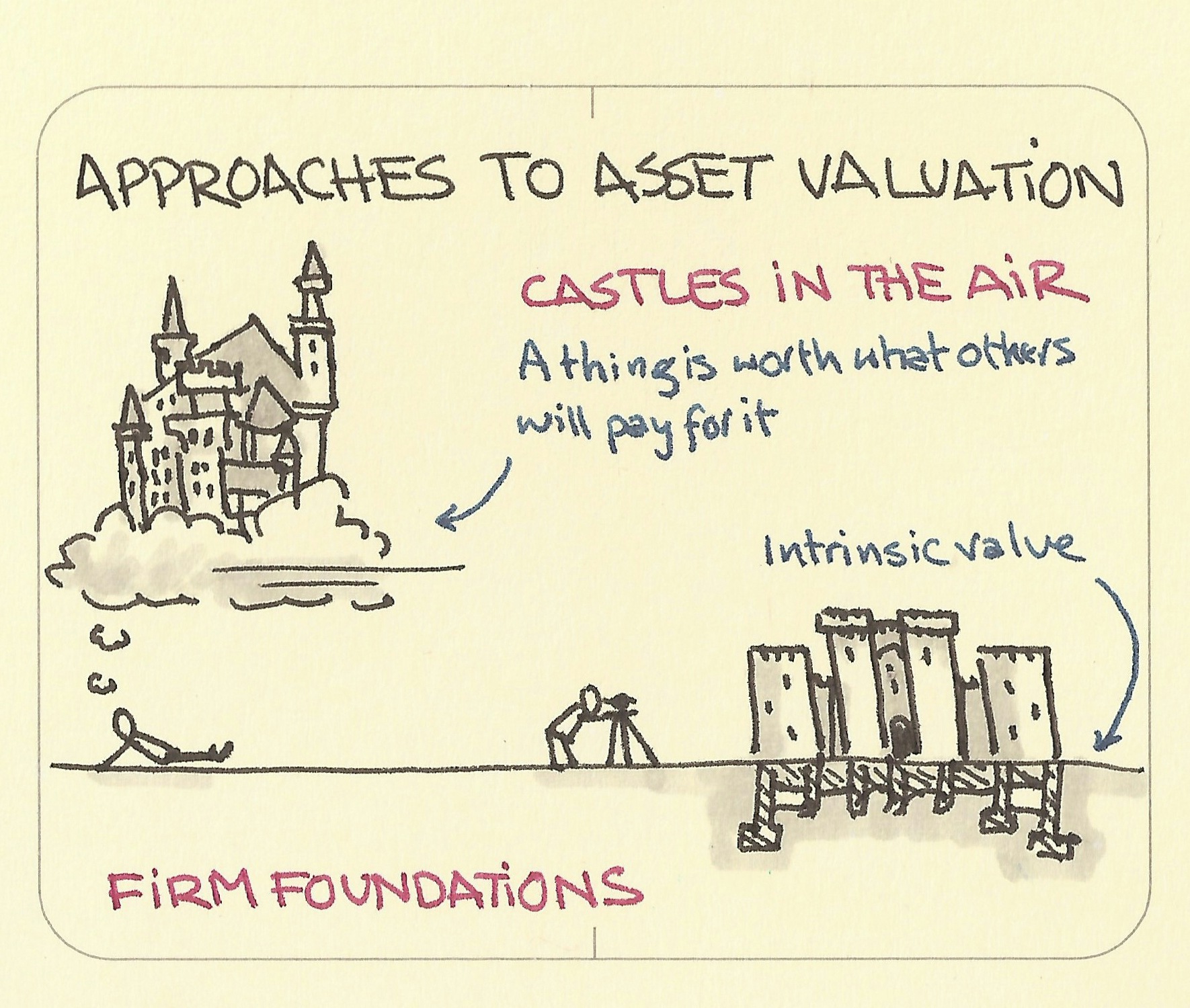

Approaches to asset valuation: Castles in the air and firm foundations

- Download

- Copied!

👇 Get new sketches each week

How do we decide what something is worth? How might a new pair of sneakers be worth $1,000 while the pair next to them, perhaps better made, longer lasting and just as comfortable, be less than $100?

With the castles in the air approach, a thing is worth what others will pay for it. If you can sell it to someone for twice the price then it’s worth that. You’ll often see this in bubbles (dot com, tulip, bitcoin…). It was described by John Maynard Keynes using the analogy of a beauty contest where you have to select the prettiest faces out of 100, and the prize goes to the selection closest to the group as a whole. Whether or not they’re actually pretty doesn’t matter if you can guess which faces others think are pretty. If you can predict what the crowd will do, then you can get there first and make a profit.

The firm foundations approach, on the other hand, is about finding solid reasons for assessing value based on analysis of the fundamentals of an asset, a firm anchor, its intrinsic value. If you can value something through this approach then a good bet is simply if the current asking price is less than the intrinsic value. The market will eventually correct for it and you’ll make money.

See A Random Walk Down Wall Street, by Burton Malkiel for more.

Also see Veblen goods