Prospect theory

- Download

- Copied!

👇 Get new sketches each week

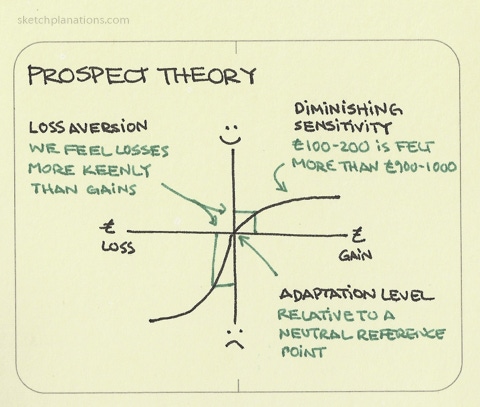

Dan Kahneman and Amos Tversky’ s behavioural economics theory modeling how we make decisions. It illustrates, among other things, some of the non-rational decisions we make as we are guided by emotion and heuristics in decisions. The sketch points out a few of the key points:

- Loss aversion - the different shape of the curves as we make gains or losses (either side of the centre) represents how a loss of £100 annoys us much more than a gain of £100 gives us pleasure.

- Diminishing sensitivity - the levelling off of the curves represents that we’ll enjoy winning £100, if we only have £100, much more than we’d enjoy winning £100 if we had £900.

- Adaptation level - We don’t evaluate from some absolute level - we evaluate whether something is good or bad from a neutral reference point that we adapt to. So, by the end of a movie the movie theatre doesn’t feel dark, yet walking out feels blinding. Your reaction to the £100 example above was probably affected by whether you think £100 is a lot of money or a little, which is all to do with your adaptation level.

Published